The boards of Newcrest and Harmony have reviewed the Wafi-Golpu Stage One Feasibility Study and Stage Two Prefeasibility Study prepared by the Wafi-Golpu Joint Venture project team.

The boards of Newcrest and Harmony have reviewed the Wafi-Golpu Stage One Feasibility Study and Stage Two Prefeasibility Study prepared by the Wafi-Golpu Joint Venture project team. As planned, the feasibility study for Stage One has completed sufficient work to justify access declines which are required to undertake more drilling of the orebody at depth to inform the next stage of the feasibility study.

The Joint Venture Partners continue to work with the Papua New Guinea Government to finalise a Pre Mine Development Agreement (PMDA) in advance of Board consideration as to whether or not to proceed with access declines.

Key Findings of the Feasibility Study work to date:

- The Golpu porphyry is a world-class copper-gold resource due to its large scale, high grade, long-life with low operating costs and embedded upside options.

- The Wafi-Golpu Stage One Feasibility Study investigated the establishment of two block caves (block cave one (BC1) and a deeper block cave two (BC2)), along with associated infrastructure; processing plant, roads, electricity, water management and port facilities.

- Financial metrics[2] of Stage One:

- NPV of USD ~1.1bn (real)

- IRR of ~15% (real)

- Payback of ~10 years from commencement of earthworks for access declines

- Block caving was evaluated and confirmed as the preferred mining method for the following reasons:

- Orebody geometry and indicative geotechnical conditions are suited to block caving

- It is a high productivity, low operating cost mining method

- The higher value material located at depth can be brought into production earlier

- Stage One is an initial development of a high quality resource which, by targeting higher-grade sections of the deposit and optimising the capital expenditure profile through a staged development approach, maximises early production and thereby free cash flow.

- The Stage Two Prefeasibility Study focused on expanding and optimising BC2 and the establishment of a third block cave (BC3).

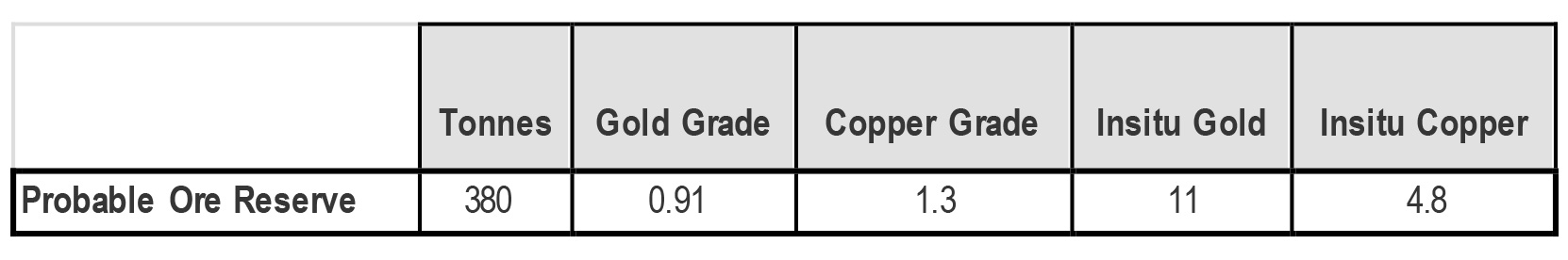

- The updated Ore Reserve as at 31 December 2015, based on the Stage Two Prefeasibility Study, is estimated to contain 11 million ounces of gold and 4.8 million tonnes of copper.

Wafi-Golpu Stage One Feasibility Study

Schematic cross section of Golpu porphyry

Stage One of the development of Golpu focuses on the development of two block caves, BC 1 and BC 2, and all associated infrastructure required to achieve first production.

The staged development approach has multiple common-path benefits, including:

- risking the project

- affording operational optionality and flexibility

- achieving a shorter timeline to achieving commercial production (targeting BC1 first)

- scalability, which affords appropriate business and operational flexibility

- the ability to respond and adapt to changing market conditions

- alignment to existing regional infrastructure

The copper grade of the Golpu concentrate is estimated to be of good quality and with an estimated range of 28-32% while mining high grade porphyry in the first ~10 years. Gold-in-concentrate grade is estimated to be 5-15g/t.

Key milestones

The next key step in the project is to sign a PMDA with the Papua New Guinea Government. Once signed approval will be sought from the Boards of both Wafi-Golpu joint venture parties to proceed with the advanced exploration work and earthworks for access declines.

The final investment decision for full project capital expenditures will be made only after all necessary permits, approvals and consents have been obtained from the Government, landowners and any other relevant stakeholders. Assuming all such approvals are obtained, the development timeline outlined in the Stage One Feasibility Study is set out below.

Further work on the Stage One Feasibility Study

As planned the following areas will be the focus of further study to optimise the study outcomes and incorporate additional data which will be collected in the Advanced Exploration and Feasibility support stage.

Access declines: Access declines into the orebody are required to fully verify structural and hydrological interpretations of the orebody and inform decisions on the remaining areas of the Feasibility Study.

Geotechnical interpretation: Further drilling work is required to support assumptions of the strength of the material in each cave and the rock mass response to fragmentation.

Tailings management: Further assessment of tailings strategies.

Hydrology: The management of water will be central to the success of the mining operation, primarily due to the nature of the geological environment of the project site. Further investigation and modelling of water will focus on increasing the confidence in the geohydrology model by obtaining additional data from drilling campaigns, modelling the effectiveness of a dewatering bore field around the block cave subsidence zone, and streamflow and surface hydrology modelling and management.

Permitting and environmental approvals: Work will continue with the PNG Government on obtaining statutory environmental approvals and other regulatory permits for the project.

Port and power: Further assessment of optimal arrangements for port facilities and power supply.

Community engagement

In parallel with further technical studies and project definition, the local communities will be actively engaged and appraised of the project development roadmap and next steps. In the December FY2016 quarter, 90 meetings attracting 2,756 local community participants were held. The three major communities involved are the Hengambu, Yanta and Babuaf spread over 15 villages in the region. The local communities remain supportive of the project.

Wafi-Golpu Stage Two Prefeasibility Study

Key decision points for staged development from Stage One to Stage Two

The first step of Stage Two will be debottlenecking the Stage One processing plant. The aim of the debottlenecking is to increase production capacity of the 6Mtpa Stage One facility to 7Mtpa by making minor and low cost modifications to the process plant grinding circuit and the underground material handling system. (Stage 2-1)

The second step for Stage Two will be to expand processing capacity to 14mtpa and increase the mine’s production rate. This will be done by optimising all the inherited Stage One infrastructure and achieving a higher mining production output from BC2, without significant additional infrastructure such as additional ventilation shafts or belt conveyor declines. It is envisaged a second process plant capable of processing 7mtpa would be constructed to bring total plant capacity to 14mtpa. (Stage 2-2).

The third and final stage investigated by the prefeasibility study for Stage Two was the construction of a third block cave. Additional capital is required to extend the decline access and belt conveying system, and establish the associated underground infrastructure. (Stage 2-3).

Golpu Ore Reserve and Resource

The updated Ore Reserve as at 31 December 2015 is estimated to contain 11 million ounces of gold and 4.8 million tonnes of copper. This includes a decrease of 1.4 million ounces of gold and 0.6 million tonnes of copper compared to previous estimates in line with updated long term cost and metal price assumptions and optimised designs in the Wafi-Golpu Stage One Feasibility Study and Stage Two Prefeasibility Study. Note that silver has been removed from the Golpu Ore Reserve as it is no longer considered to be at payable levels in the copper concentrate (Refer Golpu Ore Reserve Table below).

Golpu Ore Reserve

The updated Mineral Resource as at 31 December 2015 is estimated to contain 18.6 million ounces of gold and 8.6 million tonnes of copper. This includes a decrease of 1.6 million ounces of gold and 0.8 million tonnes of copper compared to previous estimates within an updated notional constraining shell. The Mineral Resource is in line with updated long term cost and metal price assumptions of the Wafi-Golpu Stage Two Prefeasibility Study. (Refer Golpu Mineral Resource Table below). Mineral Resources are reported inclusive of Ore Reserves.

Golpu Mineral Resource

About the Wafi-Golpu Project

Newcrest and Harmony Gold Mining Company Limited (Harmony) each currently own 50% of Wafi-Golpu through the Wafi-Golpu Joint Venture. The PNG Government retains the right to purchase, for its pro-rata share of historical costs, up to a 30% equity interest in any mineral discovery at Wafi-Golpu, at any time before the commencement of mining. If the PNG Government chooses to take-up its full 30% interest, the interest of each of Newcrest and Harmony will become 35%.

The Wafi-Golpu deposit is located approximately 60km south-west of Lae in the Morobe Province of PNG which is the second largest city in PNG and will host Wafi-Golpu’s export facilities. The proposed mine site sits at an elevation of approximately 400 metres above sea level in moderately hilly terrain and is located near the Watut River approximately 30km upstream from the confluence of the Watut and Markham rivers.